Contents:

Production is a flow as it is always with reference to a period of time. Capital is a stock because it is measured at a point of time. Loss is a flow because losses are always with reference to a period of time. Its main tools are aggregate demand and aggregate supply of the economy as a whole.

The expenditure approach or spending approach calculates GDP by adding all expenditures made by all individuals in an economy. This expenditure is known as Gross Domestic Capital Formation . Expenditure by non-residents of a country is not included in HFCE. However, the expenditure incurred by the national residents in foreign countries is included in HFCE. In addition, HFCE excludes the receipts from the sale of pre-owned goods, wastes, and scraps. Now, using the value-added method, we aim to calculate national income .

- ClearTax can also help you in getting your business registered for Goods & Services Tax Law.

- Economy is viewed as a collection of units used for consumption, saving, and investment.

- Refers to the amount payable by the production unit for using the borrowed money.

- Only the final value of goods and services is considered to avoid double counting.

- Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner.

The word gross in GVAmp indicates the inclusion of depreciation. GDP is considered a key tool to guide policymakers, investors, and businesses in strategic decision making. In India, contributions to GDP are mainly divided into 3 broad sectors – Agriculture and Allied Services, Manufacturing Sector and Service Sector. Let’s understand what is the significace of Gross Domestic Product, How it is calculated and What are Methods of GDP Calculation, in this article. From the following data, calculate the GDP at both Market price, and Factor Cost.

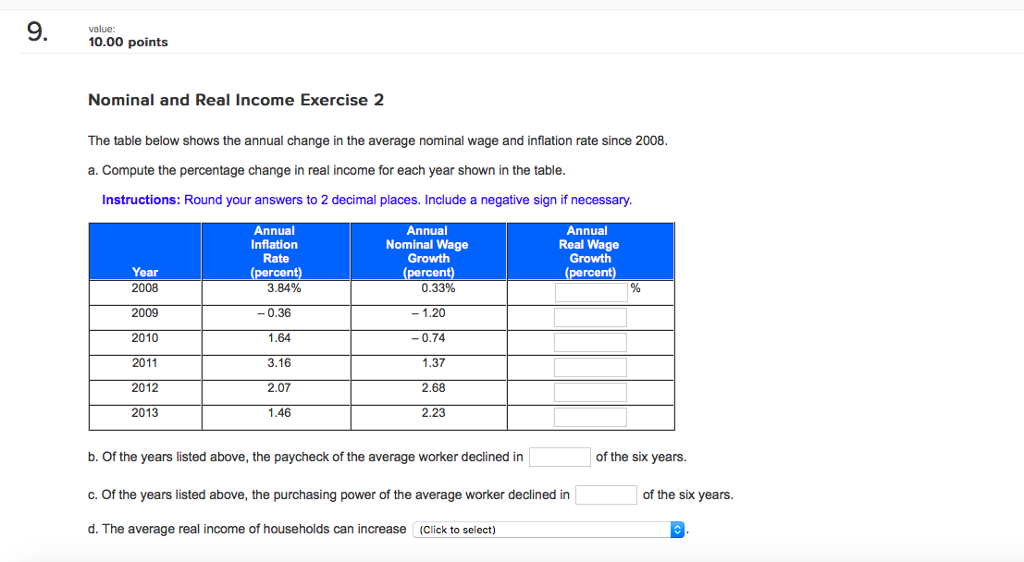

Expenditure Method in calculating GDP

Also, it is emphasised that you should be clearing your doubts at the source, carrying forward them could lead to more confusion and more weak areas. Expenses incurred by businesses for purchasing or constructing residential units upon receiving tenders. On dividing the National Income by population, the per capita income can be found out.

Classifying the production units into primary, secondary, and tertiary sectors. Let us discuss the different methods of measuring national income (as shown in Figure-1). Methods used for calculating national income are – Value-added method , Income method, and, the Expenditure method . GFCF includes business expenses incurred towards long-term assets and investment in residential units by businesses or households. To learn more about the Expenditure method, its formula, and its different factors refer to our study materials today. Learn through a series of interactive courses and curated Q&As crafted by our skilled mentors to sharpen your knowledge.

expenditure method formula Regarding Calculation of National Incme by Expenditure Method. Expenditure on only final goods and services should be included in the national income estimation while intermediate consumption expenditure should not be included. The second approach, known as the expenditure approach, is the converse of Income approach as rather than Income, it begins with money spent on goods & services. This measures the total expenditure incurred by all entities on goods and services within the domestic boundaries of a country.

- Traditionally, there are four factors of production, namely land, labor, capital, and organization.

- Short-run aggregate demand only calculates total output at a single nominal price point or the average current prices across the whole range of economically manufactured goods and services.

- It can be divided into two categories – purchases of durable and non-durable goods, and procurement of services.

- It is also helpful in determining the progress of the country.

- While several developed countries impose several fines and penalties on industries violating environmental laws, some developing ones ignore the same to promote the growth of their economy.

4) Production of goods for self-consumption will be included – It’s not included in national income as they contribute to current output. Their value is to be estimated or imputed as they are not sold in the market. Refers to the amount payable by the production unit for using the borrowed money. Generally, production units borrow for making investment and households borrow for meeting consumption expenditure.

Calculation Methodologies of GDP

Because GDP provides a direct indication of the health and growth of the economy, businesses can use GDP as a guide to their business strategy. Investors also watch other economic indicators since it provides a framework for investment decision-making. Purchase of any second-hand goods is not included in the total Expenditure method as these do not affect the total value of goods and services produced. However, any brokerage paid on the purchase of such goods or services has to be included in the calculation. Any expenses on account of intermediate goods cannot be considered to determine a nation’s Income as these expenses are already included in the value of final goods produced.

Inadequate dietary diversity practices and associated factors among … – Nature.com

Inadequate dietary diversity practices and associated factors among ….

Posted: Thu, 04 May 2023 11:35:11 GMT [source]

It refers to the difference between exports and imports of a country during a period of one year. Explain the impact of rise in exchange rate on national income. Explain with an example, factor income to abroad and factor income from abroad. ClearTax offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. ClearTax serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India. Students must have understood the Expenditure method, how is GDP determined, the formula, primary components and the precautions that are taken while calculating.

What is Expenditure Method and Income Method – Toppr-guides

On the other hand, intermediate consumption refers to the value of non-durable goods and services purchased by a production unit from another production unit in particular period of time. These goods and services used up or resold during that particular period of time. The value-added method, the income method, and the expenditure method are the three most prevalent Methodologies. The income approach concentrates on the income received from production variables such as land and labour.

SlimSwitch Reviews – Real Weight Loss Mountaintop Method Formula Worth It? – The Tribune India

SlimSwitch Reviews – Real Weight Loss Mountaintop Method Formula Worth It?.

Posted: Wed, 26 Apr 2023 10:52:00 GMT [source]

Estimating the final expenditures on goods and services by industrial sectors. The expenditure also includes net exports, which are equal to exports minus imports. HFCE is defined as expenditures, both actual and imputed, incurred by a country’s households on final goods and services for satisfying their wants. In addition to actual money expenditure, HFCE includes imputed value of goods and services received without incurring money expenditure, for example, self-consumed output and gifts received in kind.

Production units in an economy are classified into primary, secondary, and tertiary sectors. On the basis of this classification, value-added method is used to measure national income. The three most common methods are the value-added method, the income method, and the expenditure method. The value-added method focuses on the value added to a product at each stage of its production. Explain the income method and expenditure method of measuring national income. I. Identification of economic units incurring final expenditure, e.g., household sector, firm sector and government sector.

According to the method national income is measured in terms of expenditures on the purchase of final goods and services produced in the economy during the accounting year. Under this process, the GDP is determined by summing up all of the final goods and services expenditure. Nonetheless, scientifically this similarity is not always present in the real world, especially when analyzing GDP over the long run.

Short-run aggregate demand only calculates total output at a single nominal price point or the average current prices across the whole range of economically manufactured goods and services. In the long run, aggregate demand is equal to GDP only when the price level is adjusted. This process produces nominal GDP, which then has to be modified for inflation in order to produce actual GDP. Any expenses incurred due to producing goods for self-consumption, services provided by the government and non-profit institutions are also included in the National Income.

Contrarily, any brokerage earned on the trading of shares will be considered as a productive service. Consumer spending usually accounts for a large part of a nation’s GDP. It can be divided into two categories – purchases of durable and non-durable goods, and procurement of services. If the rate and growth of population are greater than the rate and growth of GDP, then it will decrease per – availability of goods and services which would adversely affect economic welfare. Change in P rice – If GDP is increasing due to increase in price rather than the increase in production, then it will not be a reliable index of economic welfare. It measures the average level of prices of all the goods and services that make up GDP.

The best way to do that is trying to attempt a lot of sample papers at home and setting time boundaries for the same. Any transfer payment should not be included under the Expenditure formula as these payments do not add any value to a nation’s economy. Business investments include capital Expenditures on assets by different organizations.

In short one can say that the national income of any country is the total amount of income that is accrued by it through various economic activities in one year. It is also helpful in determining the progress of the country. For determining the effects of environmental damage on GDP, greengross domestic productor GGNP was devised. GGNP is an index for economic progress factoring the harms done environment for the same. Non-market transactions like voluntary, domestic, or other work that have a positive impact on the productivity of workers are excluded from GDP.

In these professions, owners themselves assume the role of an entrepreneur, financier, worker and landlords. Mixed income also takes into account the income of those individuals who earn from different sources, such as wages rents on own property, and interests on own money. This is because these goods are already counted when sold for the first time. The output of only newly produced goods is included in total output. However, the value of services provided by agents in selling pre-owned goods is fresh output and should be included in the total output.

Taking the sum of the final expenditures which gives GDPmp. Third is the retained earnings called undistributed profits. Thus, profit Is the sum total of corporate profit tax, dividend, and retained earnings. Refers to the amount payable in cash or in kind by a tenant to the landlord for using land. In national income accounting, the term rent is restricted to land and not to other goods, such as machinery. National income can be defined by taking three viewpoints, namely production viewpoint, income viewpoint, and expenditure viewpoint.

Examples are cloth mills, sugar mills, steel industry, shoe factory, biscuit factory, etc. In India, a government agency, named, Central Statistical Organisation which computes official estimates of national income and related aggregates has divided the entire economy into following three sectors. Broadly primary sector exploits natural resources; secondary sector transforms one type of commodity into other; and tertiary sector renders services as explained below.

This is because value-added method estimates national income from the sales side, whereas the expenditure method calculates national income from the purchase side. Economy is also viewed as a combination of individuals and households owing different kinds of factors of production. On the basis of this combination, income method is used for estimating national income. Including the imputed value of factor services rendered by the owners of production units themselves. For example, if production units use their own savings for production, then the interest is payable to them in the form of imputed interest. This imputed interest should be added in the calculation of national income.